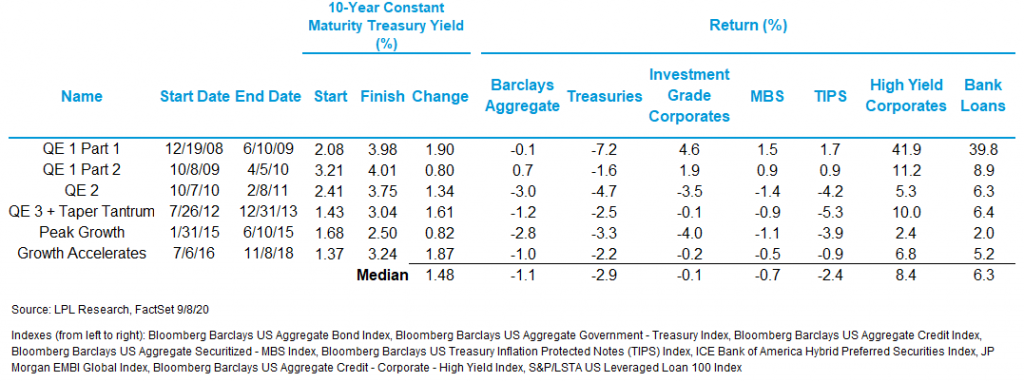

While the direction of the 10-year Treasury yield over the last cycle was decidedly lower, as shown in LPL’s Chart of the Day, there were still six extended periods where it rose at least 0.75%, and in two of those it rose almost 2%. Looking ahead, economic growth below potential, slack in the labor market, […]

5 Lessons Learned About Rising Rates