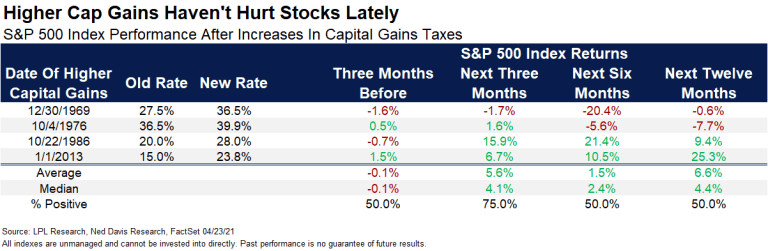

“Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes,” Benjamin Franklin First off, we hope everyone has a happy and safe Cinco de Mayo! One of the big discussions lately has been about how will higher taxes potentially impact […]

Let’s Talk About Stocks And Higher Taxes