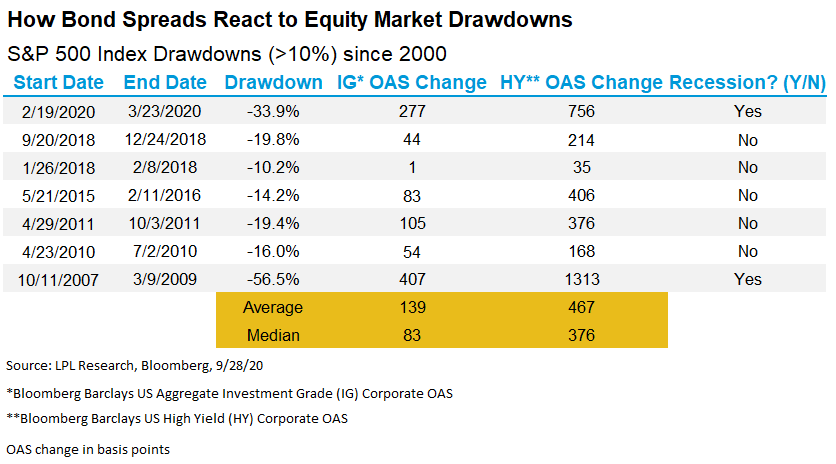

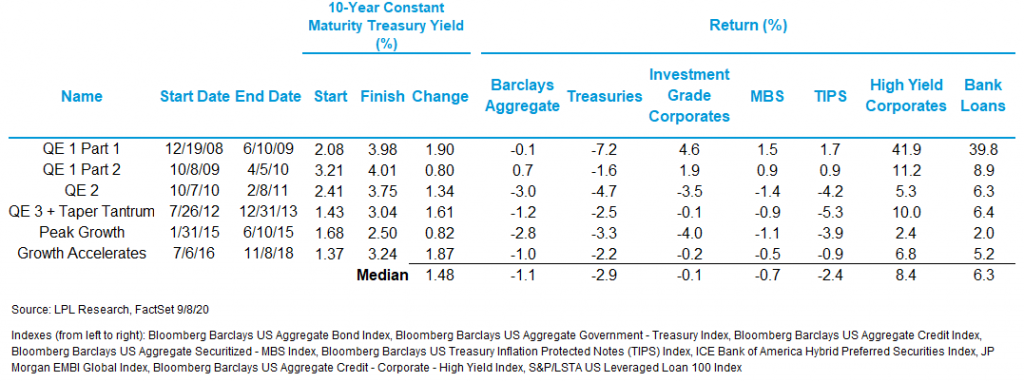

An old Wall Street adage says bond markets are smarter than equity markets, so when stocks encounter volatility, investors often look to the bond market for clues about the potential severity of equity market weakness. The option-adjusted spread (OAS), a key data point, adjusts a bond’s yield for any unique features of the bond in […]

How Corporate Bond Spreads Respond to Equity Market Volatility