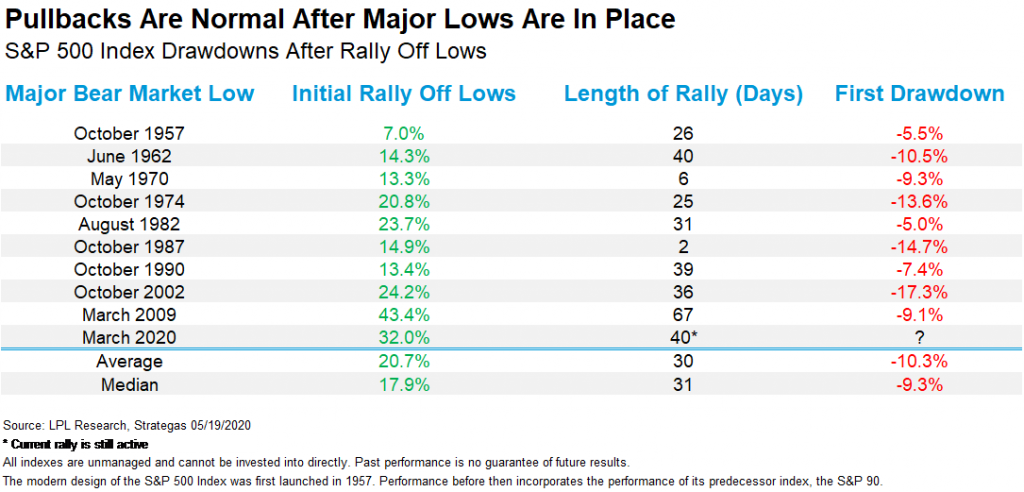

The S&P 500 Index flirted with closing above 3,000 yesterday, even as much of the economic data is some of the worst we’ve ever seen in our lifetimes. We are often asked how this is possible. The reality is the double backstop of historic fiscal and monetary policy combined with optimism over a potential vaccine […]

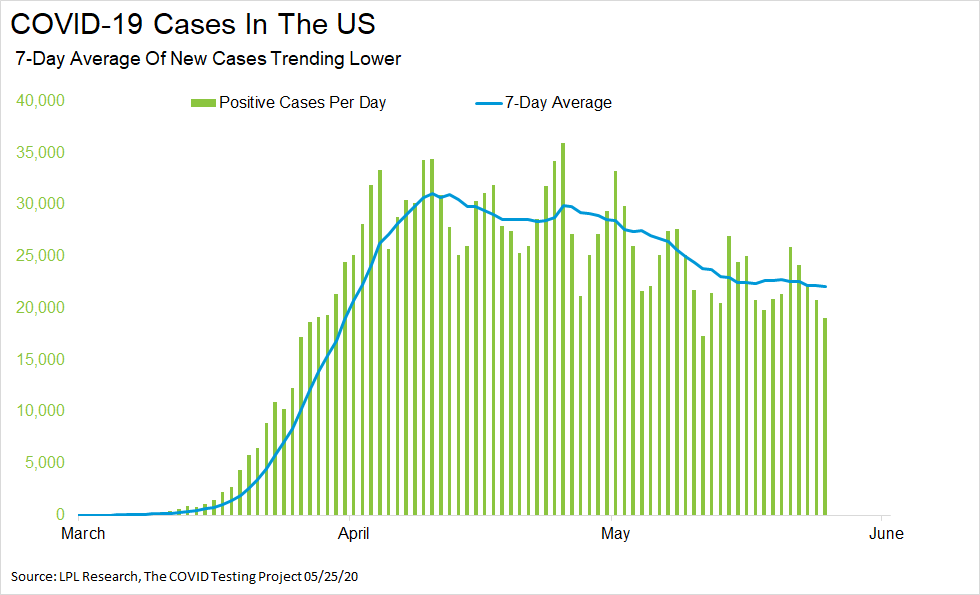

COVID-19 In Charts