End of Recession Call May Come Soon

Incredibly, the COVID recession may have ended a year ago, but we still don’t have call from the National Bureau of Economic Research (NBER). That may when the first estimate of Q1 2021 gross domestic product (GDP) growth is released tomorrow. The Q1 numbers are likely to show nearly a full year of strong growth now behind us following the dramatic slowdown of the US economy in March and April 2020 due to efforts to contain the COVID-19 pandemic.

“Markets are forward looking and have been telling us the recession is over for some time,” said LPL Research Chief Market Strategist Ryan Detrick, “but an official recession call may still bring some peace of mind. NBER is smart to take their time, but the data is becoming increasingly clear and Thursday will likely bring further confirmation.”

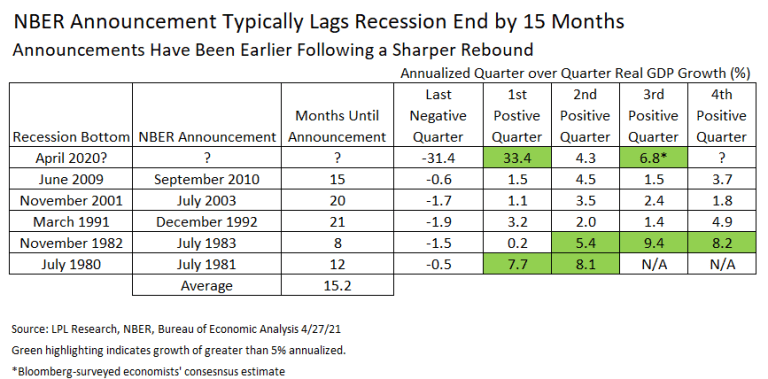

The delay isn’t surprising. NBER has never changed a call once they’ve made it. They’re acting as economic historians and need to be nearly certain. As shown in the LPL Chart of the Day, they’ve typically had to wait an average of 15 months after a recession is over before they’ve had the clarity needed to make a call, a process they’ve been doing in real time since the late 1970s.

While the average time from the end of a recession to NBER’s call has been 15 months, the two times we’ve had multiple quarters of growth over 5% (highlighted in green), the call has been quicker, averaging just 10 months. We may get our second quarter above 5% for the current cycle tomorrow. The current Bloomberg economists’ consensus sits a good margin above that level at 6.9%. If our estimate that the economic trough was in April 2020 is correct, that would put us about 12 months past the recession’s end, just a little longer than the average when there’s been a large economic rebound.

The impact on markets, however, may not be what you would expect. As is typical for bear markets, the S&P 500 low, back on March 23, 2020, likely took place somewhere in the middle of a very short but steep recession. As discussed in a recent Weekly Market Commentary, the second year of a bull market typically sees continued gains but also increased volatility with larger pullbacks. An announcement by NBER in the coming month or two would be welcome and something to celebrate, and we expect more than a full year of continued above-average gains compared to the 2009-2020 expansion ahead, although growth is likely to start to slow after the second quarter.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05138201