Historic Surge for the Energy Sector

The energy sector has certainly been on a wild ride over the course of the past year, perhaps the wildest of all of the S&P 500 sectors. The outbreak of the pandemic in 2020 caused such a demand shock that oil futures traded for a negative value for the first time in history, implying that someone would pay you to take delivery of their oil!

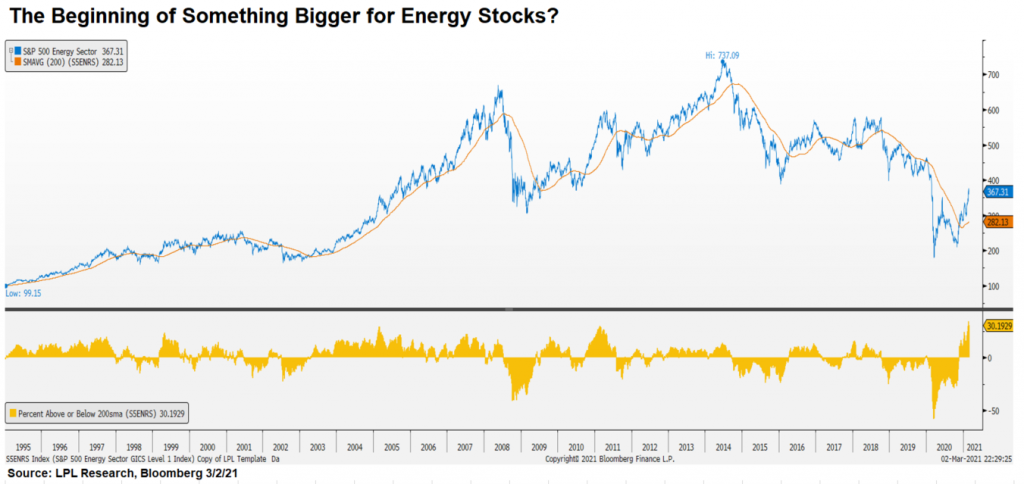

Well, that’s in the rear-view mirror for the energy market now. Year to date, the S&P 500 energy sector is up over 29% as of March 2, according to data from FactSet, more than double the return of the financial sector, the second strongest sector thus far in 2021. As shown in the LPL Chart of the Day, the S&P 500 energy sector is trading at a blistering 30% above its 200-day moving average, the most ever using data back to 1990. While this might seem bearish on the surface, previous surges above 20% have historically bought above average returns over the next year rather than below average.

“The case can be made that energy could be a bit stretched in the near-term, but momentum often breeds more momentum,” added LPL Financial Chief Market Strategist Ryan Detrick. “Energy has been unloved for quite some time, but we may be in the early innings of a larger rally for the energy sector as the global economy continues to improve.”

A confluence of events may be spurring the boom in the energy sector. An expanding global economy, a historic winter storm that shut down major oil producing states like Texas and Oklahoma, and an output agreement from members of OPEC+ have sent oil prices soaring to their highest level since early 2019. It’s not just oil, either. Copper and lumber have surged past their 2019 highs as well. It’s no secret that inflation expectations have been on the rise, and the surge in commodity prices are likely adding further credence to the market’s view of higher inflation.

We have continued to warm up to the energy sector, including upgrading our view on oil in January and then our upgrade from negative to neutral in our February Global Portfolio Strategy publication.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1- 05117702