June Swoon?

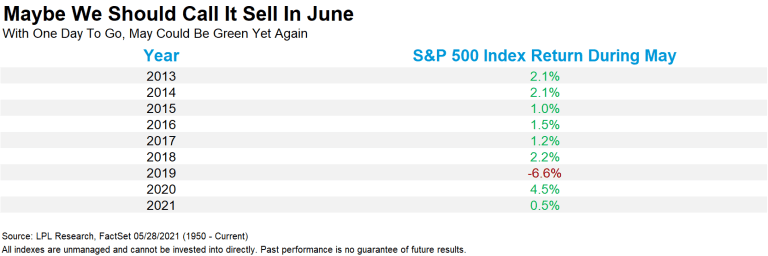

Although there was some notable weakness in the middle of May, the S&P 500 Index was able to rally late in the month to finish with a modest gain. Incredibly, this was the eighth year out of the past nine that stocks gained during in May. Who said Sell in May?

As we noted a month ago, the worst six months of the year indeed are May through October, so we are still in the thick of a potentially challenging period based on seasonality. “After a nearly 90% rally off the lows, stocks could be ripe for a pullback, especially during the historically weak month of June,” explained LPL Financial Chief Market Strategist Ryan Detrick. “But with the improving economy, coupled with historic fiscal and monetary stimulus, we expect any weakness to be short-lived.”

Here are some stats to think about regarding S&P 500 performance in June:

- Since 1950, June is the 4th worst month of the year (September, February, and August are worse).

- It has been higher the past 5 years in a row, the longest since a stretch of 6 in a row in the late 1990s.

- The past 10 years, though, June was up 1.0% on average, ranking as the 7th best month.

- According to Sam Stovall of CFRA, only 5 market declines in excess of 5% started in June versus an average of 8 for all 12 months (since WWII). In other words, it isn’t common for major market weakness to start in June.

- Building on this, when the S&P 500 is lower in June, it is down by 2.9% on average. This is the second smallest average loss, with only December better at -2.5%.

We wouldn’t be surprised at all if stocks took a well-deserved break in June, but this month is rather misunderstood, as a massive sell-off or the start of significant weakness isn’t likely, as that isn’t what June typically brings.

Lastly, last Wednesday marked the 100th trading day of the year for the S&P 500. In fact, the S&P 500 was up more than 10% on the 100th day, which historically is a great start to the year, but also has meant continued strong performance the rest of the year is quite normal.

As shown in the LPL Chart of the Day, when stocks are up more than 10% on day 100, the rest of the year has been higher 84.2% of the time and up 8.6% on average, both well above what the average year does. We continue to recommend an overweight to equities and underweight to fixed-income position relative to investors’ targets, as appropriate.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05150697