Markets Continue Lower on COVID-19 Variant Fears

U.S. and International Equities

Major Markets Lower

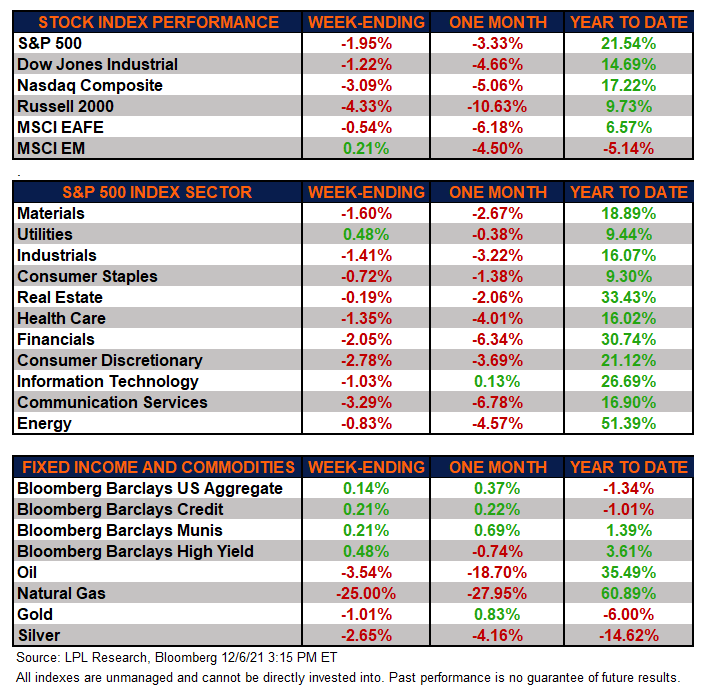

The major equity markets finished the week lower. The markets continued to pull back following last Friday’s announcement concerning the new Omicron COVID-19 variant that has now spread globally. The S&P 500 Index suffered its worst two-day performance in over a year this week. Only the utilities sector finished higher as all sector finished the week lower.

Developed international equities, as represented by the MSCI EAFE Index, followed U.S. markets lower. The one bright spot this week was emerging markets, as represented by the MSCI EM Index. Amid concerns over China’s continued regulatory crackdown and its economic trajectory, bargain hunters added risk to this area.

Bonds Rally In Light of Variant and Inflation Concerns

The Bloomberg Aggregate Bond Index finished higher this week as high-quality bonds saw strong demand from the flight-to-safety trade. High-yield corporate bonds, as tracked by the Bloomberg Barclays High Yield index, rebounded after a three week sell-off on inflation concerns.

Commodities Pull Back for a Second Straight Week

Commodities had their second straight down week on the back of concerns surrounding the effects of the Omicron variant on the global economy and travel. Natural gas was the notable decliner, pulling back almost 25% for the week.

Economic Weekly Roundup

Fed Talk

Federal Reserve (Fed) Chairman Jerome Powell testified before Congress this week. Powell acknowledged the risks related to Omicron, but given the genesis of the virus, he was unable to comment further. He acknowledged that the effects of the Omicron variant will be analyzed by the Fed once more data is available.

With regard to inflation, Powell retired the word “transitory” while reiterating that elevated inflation is fundamentally due to supply and demand imbalances. Powell also indicated that tapering might be accelerated by a few months, which led market participants to interpret the Fed’s updated commentary as a hawkish shift.

Global Supply Chain Pressures Moderate

The November global manufacturing Purchasing Managers’ Index came in broadly unchanged. Strength in new global orders continued to outpace output, which is a positive signal for future growth. Moreover, what is most encouraging was that fewer firms reported higher order backlogs along with longer suppliers’ delivery times. This indicates some relief on global supply chain strains.

Continuing Claims Decline below 2 million; November Jobs Weak

The employment landscape continues to improve as continuing claims for unemployment insurance fell below the 2 million milestone and a new pandemic low. Initial claims increased from the revised prior reading, however they beat economist expectations.

The news from the monthly employment report was not as good. The U.S. economy added 210,000 jobs in November, well below the consensus expectation of over 500,000. However, the unemployment rate fell sharply to 4.2% from 4.6% last month as new workers entered the job market, pushing the labor participation rate up slightly to 61.8%, a post-recession high but still well off pre-pandemic levels.

The following economic data is slated to be released during the week ahead:

- Tuesday: Q3 unit labor costs and productivity, October trade balance and consumer credits

- Wednesday: October U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS)

- Thursday: Weekly initial and continuing unemployment claims, October wholesale inventories

- Friday: November Consumer Price Index, workweek statistics, Treasury budget, December University of Michigan index

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05219323