The Fed and Ukraine Influence This Week’s Markets

U.S. and International Equities

U.S. Markets Lower

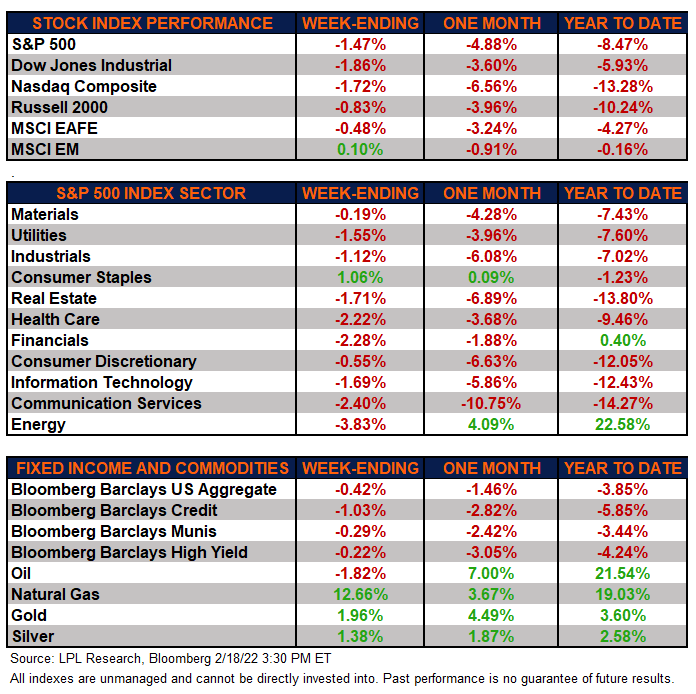

The U.S. major equity markets finished lower for the second straight week. With roughly 85% of S&P 500 companies having reported, fourth quarter earnings growth for the index is tracking to a 31.4% year-over-year increase, yet stocks tracked lower amid fears of an imminent Russian invasion of Ukraine. Meanwhile, the Federal Reserve’s (Fed) March decision on interest rates amid resinous inflation readings has also given market participants pause. The traditionally defensive consumer staples led all sectors for the week, while consumer staples and energy are the only sectors in the green over the past month.

International markets finished mixed this week, with emerging markets (MSCI EM) outperforming their U.S. and developed international counterparts. Emerging markets, which were last year’s regional laggard on the back of concerns over Chinese regulation and real estate debt challenges, are leading all the major market averages so far for 2022.

Fixed Income Continues Lower

The Bloomberg Aggregate Bond Index finished lower for the fifth straight week. High-quality bonds continue to be challenged as traders sold off longer-term government bonds and priced in a more aggressive timetable for Fed rate hikes, especially in light of last month’s hot consumer inflation report. This sentiment also carried over to high-yield corporate bonds, as tracked by the Bloomberg High Yield index, which lost ground for the week. That being said, high yield spreads, or the additional compensation for owning riskier debt, still remain well behaved due to continued favorable credit conditions.

Commodities Mixed

After last week’s pullback, natural gas gained over 12% this week. Crude oil went the other way, finishing the week lower as the commodity’s steady march higher in 2022 was interrupted by concerns about a production response to higher prices. Gold and silver finished their third straight week in the green.

“Based in part on continued Russia/Ukraine uncertainty, markets moved into defensive mode this week as stocks sold off in most segments,” explained LPL Research Senior Vice President and Director of Research Marc Zabicki. “After the S&P 500 failed to break above 4600 twice in February, and absent any good Russia news, we believe a retest of the late-January lows may be on the near-term horizon.”

Economic Weekly Roundup

January PPI Accelerates

The Producer Price Index (PPI) increased by the most in eight months in January. For the year ending January 2022, the PPI rose over 9.5%, while core PPI, which excludes food and energy, increased by more than 8% year over year. Major price increases were seen in hospital outpatient care as well as with food and automobiles. The producer price for final demand increased by 1% month over month, the biggest jump since May 2021.

Solid January Retail Sales

Amid high inflation, January retail sales were reported at almost 4% higher for the month and far exceeded economists’ expectations. Online shopping was a big driver of last month’s gain, with non-store retailers seeing a month-over-month increase of over 14% in January. Moreover, furniture and home furnishings sales increased over 7% while automobiles and related parts sales increased over 5.5%.

Fed Talk

Little new information was released in the Fed’s meeting minutes from its January Federal Open Market Committee (FOMC) meeting this week. Fed officials noted that inflation pressures were still too high and that if these price pressures lingered, the Committee would remove policy accommodation at a “faster pace” than they currently anticipate. Moreover, the Committee acknowledged inflationary pressures had broadened over the second half of 2021 and risks to their inflation forecasts were to the upside.

Jobless Claims Increase

Initial claims for unemployment insurance increased for the week ending February 12 and came in above 240,000, which were higher than what economists expected. Continuing claims declined from the prior week and came in below economists’ estimates. Consumer sentiment remains optimistic towards the labor markets according to the Conference Board as the drop in continuing claims may be signaling a long-awaited rebound in labor participation.

Week Ahead

The following economic data is slated to be released during the week ahead:

- Tuesday: December Federal Housing Finance Agency (FHFA) Home Price Index, S&P Case-Schiller Home Price Index, February U.S. Markit Purchasing Managers’ Index (PMI), Conference Board’s Consumer Confidence

- Thursday: Weekly initial and continuing unemployment claims, January new home sales, revised Q4 GDP

- Friday: January durable orders, personal income and consumption, personal consumption expenditures, pending home sales, February University of Michigan Consumer Sentiment

Next week, over 50 S&P 500 companies will report their fourth quarter 2021 earnings results.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05246870