The Market’s Mixed Election Signals

With Election Day just under a month away and voting already taking place in many states, it is still anyone’s guess who will win on November 3. With all of the noise surrounding the election, we prefer to focus on the signals coming from the market. However, perhaps even the market is having a tough time sorting out who will win once the votes are counted.

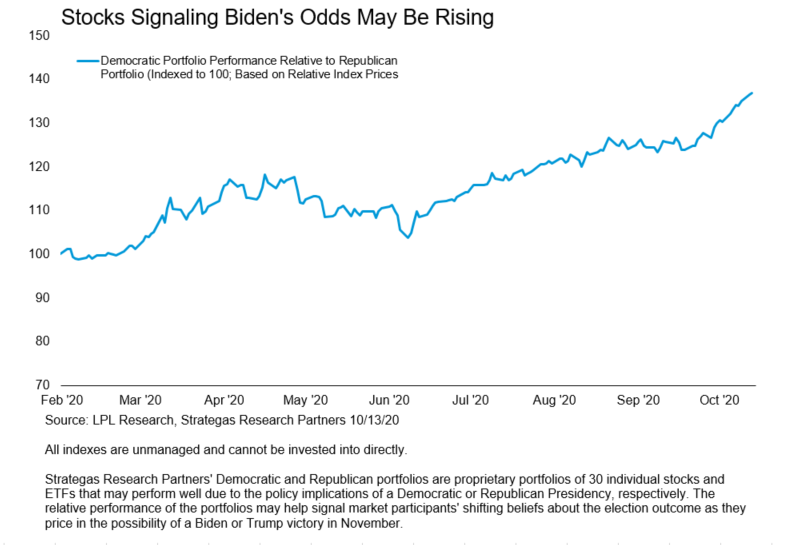

Our friends at Strategas Research Partners have put together a basket of stocks likely to benefit from a Trump or Biden presidency. As shown in the LPL Chart of the Day, the Biden portfolio has been outperforming the Trump portfolio, though we acknowledge these stocks are driven by other factors as well.

The Biden portfolio has been supported, in part, by green energy stocks, which have been on a particular tear in recent weeks. Given Joe Biden’s proposal for green energy policies, these stocks have helped drive strong performance for the Biden portfolio recently.

On the other hand, we have noted in the past that the performance of the S&P 500 in the three months prior to the election has a strong track record in predicting the fate of the incumbent party. Since August 3, the S&P 500 is currently up nearly 7% on a total return basis, suggesting that the incumbent party will win this year.

So which is it?

“We think it’s going to be a lot closer than the polls may suggest right now, similar to what we saw in 2016,” added LPL Research Chief Market Strategist Ryan Detrick.

Regardless of who may win the election, we think the continued economic rebound will support future equity gains. Further, we don’t think it is wise to base long-term portfolio decisions on the outcome of an election. In similarly polarizing elections in 2008 and 2016, investors who maintained their stock allocations were rewarded with future gains.

While headlines surrounding the election will continue to create uncertainty, we think the best response is likely to stay the course. As the improvement in the economy continues, we remain overweight stocks relative to bonds, and expect this environment will support further gains for this young bull market.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and Bloomberg.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05067198