Why Gold Will Continue To Shine

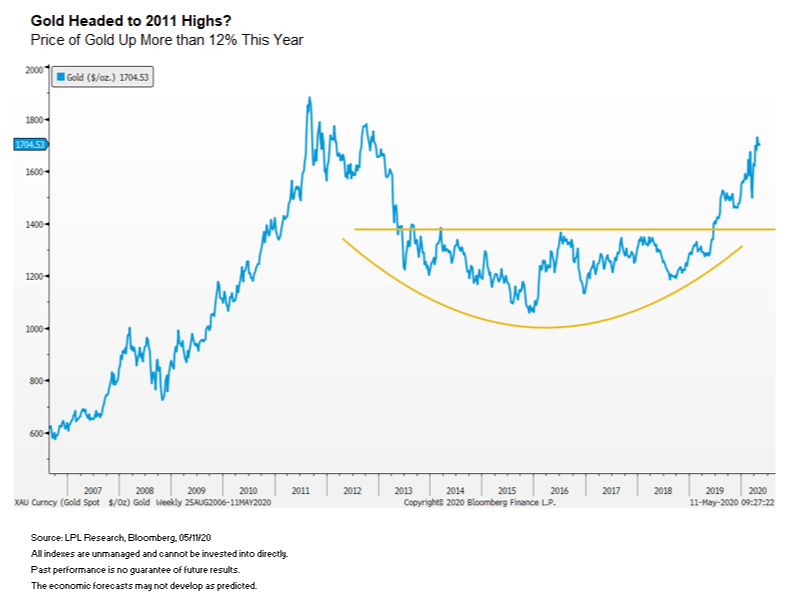

Gold has done quite well so far in 2020, up more than 12% year to date versus the S&P 500 Index which is down about 10%. We started to warm to the yellow metal late last year and continue to think it can serve as a potential hedge in a well-diversified portfolio for suitable investors.

“From COVID-19, to massive monetary stimulus, to historically lower yields, to potentially negative fed funds rates down the road, there are many reasons to think gold could continue its recent strength,” explained LPL Financial Senior Market Strategist Ryan Detrick.

As shown in the LPL Chart of the Day, gold based for years before breaking out last year. This is a strong chart from a technical perspective and eventual new highs over the coming years could be quite likely.

We continue to think equities could be due for a well-deserved break, and gold could be one place that could benefit a portfolio should that happen. For more of our investment insights and why some equity weakness could take place soon, check out Time For A Pause?

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Precious metal investing is subject to substantial fluctuation and potential for loss.

The price of gold can be affected by developments such as currency devaluations or revaluations, central bank movements, economic and social conditions within a country, trade imbalances, or trade or currency restrictions between countries. There is no guarantee that gold will maintain its value or purchasing power in the future. Gold and other speculative investments are not appropriate for every investor.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05010318