Why Inflation Worries Likely Just Peaked

As nearly everyone knows by now, inflation has soared the past few months, with the May Consumer Price Index (CPI) coming in at 5.0% year-over-year, the highest since 2008, while the core CPI (excluding energy and food) was 3.8%, the highest since 1992. The Bloomberg consensus is calling for 3.4% headline CPI this year, which has many worried about potentially runaway inflation. We do not expect that to happen and we’d side with the actual number coming in lower than the current consensus.

How much has inflation been in the news? A recent CNBC survey noted that inflation worries are now investor’s biggest worry, topping pandemic worries for the first time in 15 months. Adding to that, here is a Google Trends showing that searches for the word ‘inflation’ have never been higher going back to 2004 (the furthest back their data goes), again suggesting that higher inflation shouldn’t be a surprise.

First off, why is inflation higher? Record stimulus, a big economic recovery, major supply chain issues, a surprisingly tight labor market, and negative CPI this time a year ago (so the baseline is quite low) are all reasons inflation has soared lately. As we’ve said many times in recent months, we think the jump in inflation is transitory, and inflation will come back to trend by mid-2022.

Many of the big picture things that have kept a lid on inflation for more than a decade are still in place. Things like technological innovation, globalization, the Amazon effect, increased productivity and efficiency, automation, and high debt (which puts downward pressure on inflation) are all still firmly in play and should help keep inflation in check later this year and beyond.

“Yes, this year could see inflation upwards of 3% or a tad more, but that isn’t exactly runaway inflation from the 2% inflation rate we saw most of last decade,” explained LPL Financial Chief Market Strategist Ryan Detrick. “Coming out of the worst recession we’ve seen in our lifetime, it makes sense that inflation could run hotter this year and maybe even into 2022, but the likelihood that we have a 1970s style inflation surge is quite slim.”

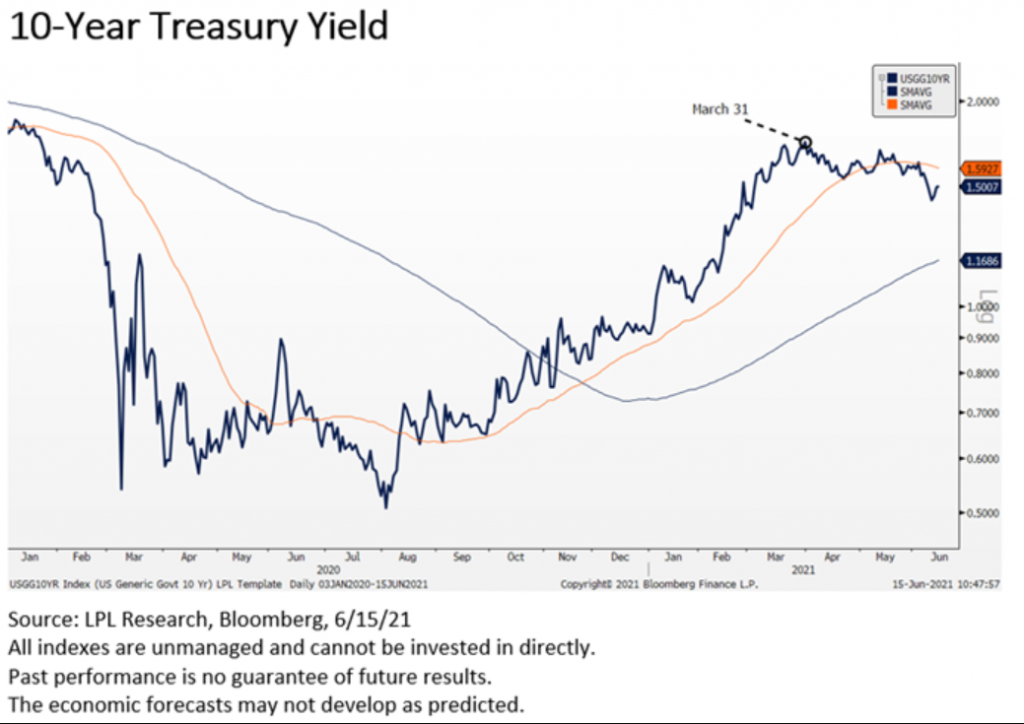

What does the market think? Odds are nearly everyone realized inflation is higher as the Google Trends data showed. In case you don’t like to Google things, just go get gas or head to the grocery store, you’ll see higher prices. But the market has a funny way of looking ahead and pricing things in well before most people understand why. There very well could be a major peak in inflation fears but the market may already be starting to move on from this worry.

Think about it, if the market was truly worried about inflation, would rates really drop in the face of that scary CPI data? Probably not.

What about lumber? It has crashed 40% recently, yet another sign inflation worries may have peaked.

Corn and soybeans appear to have also peaked.

Even copper has peaked out recently.

Recently, as we show in the LPL Chart of the Day, 10-year breakevens, a measure of market-implied inflation expectations, peaked the exact same week that Barron’s had a magazine cover talking about inflation. In other words, inflation fever had gripped us back in May and just as quickly the market had it priced in and stopped worrying so much about it. (Note – The 10-year breakeven rate measures the difference or gap between 10-year Treasury Bond and Treasury Inflation Protected Securities (TIPS). The 10 year breakeven rate serves as an indication of the markets’ inflation expectations over the 10-year horizon.)

What does it all mean? There are clear signs that higher inflation is priced into the market. Yes, we’ll get higher inflation, but it won’t be a surprise anymore. For more of our thoughts on inflation, we discuss inflation (and many other things) in our most recent LPL Market Signals podcast. You can watch it from our YouTube channel below.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05156315